Latte was diagnosed with Transitional Cell Carcinoma (TCC) back in September last year. And that's when we made our first insurance claim with Happy Tails Pet Insurance.

We have reviewed Happy Tails Pet Insurance before but only gained a full view of its pros and cons after going through real-life diagnoses, reviews, and treatments.

We insured Latte just before she turned four years old so that we could lock in the lowest co-insurance rate of 20%. Six years later, we made our first claim.

Our plan and coverage

We chose the middle-tier Furry Plan, which gives us the following benefits:

-

S$6,000 clinical and surgical treatment

-

S$600 room and board expenses

-

S$250 post-surgical treatment

-

S$1,000 chemotherapy

-

$250 final expenses

-

20% co-insurance and S$250 deductible per claim.

Through the years, our annual premium steadily increased from S$400+ to S$500+. Premiums differ between pets, according to their age and health status and may increase from year to year. You can get a quote here.

Our first Happy Tails claim

The vet found a tumour in Latte's vulva and we were advised to remove it and send it off for a biopsy. We did it with a small clinic so the bills were pretty small - around S$1,100, including pre-surgery consultation and blood test and the surgery itself.

Out of this S$1,100, we could claim:

S$1,100 total bill - (S$1,100*20% co-insurance) - S$250 deductible = S$630

It took a pretty long time for them to process the claim. The auto-replies we got said that claims would take 10 working days to process. This was wildly inaccurate. For all our medical claims, it generally took them 1.5 months to process.

This significant difference between estimated and actual processing time has sent quite a few pet parents panicking over whether they would ever get their claim back. If you are one of them, you can rest easier knowing that slow can be, unfortunately, expected.

If you want to give them a nudge or to check on the status, you can call Income at 6788 6616 during working hours. If you did not get an auto-reply within 3-5 working days after submitting your claim, give them a call to verify that they have recorded your claim.

Once our claim was processed, the money was credited within the week.

Suffice to say, if you are considering pet insurance and getting your claim quickly is crucial to your finances, this is not going to be ideal for you.

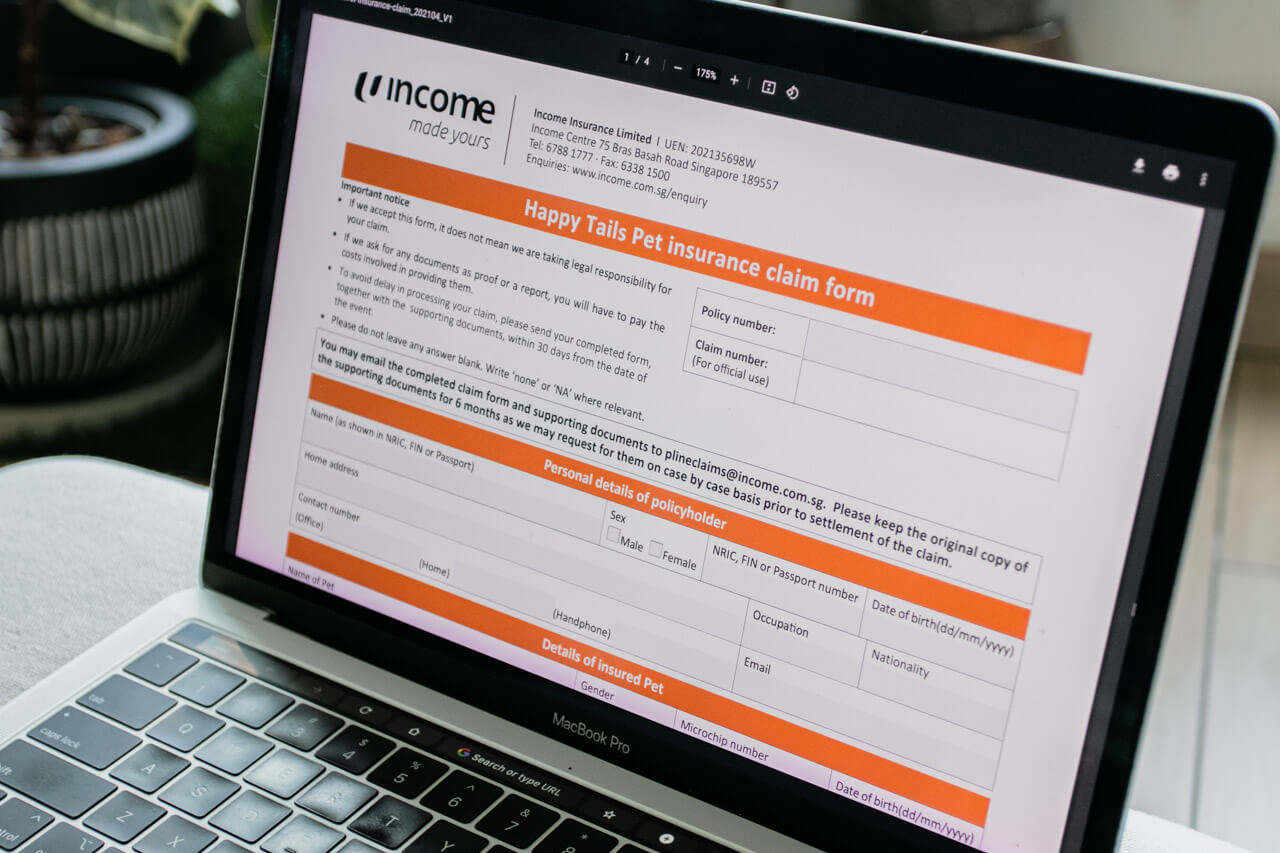

Details on how to file a claim can be found here.

Now, after finding out that Latte had TCC, we scrambled to find a reputable vet with the earliest appointment slot. And that's when we realised that the post-surgery coverage is absurd.

Our post-surgery claim

This was the moment we realised that most of the costs we were going to face were not going to be covered.

After the diagnosis, we had to do more tests to check on the extent of the condition. And because we went to an expensive vet, the first bill alone was S$1,400. No surgery, just tests and medications. And how much was our post-surgery coverage? S$300.

In total for this surgery, we claimed S$930 out of the $3,000+ that we easily spent within the eligible claim period. To be fair, it is worth noting that if were to go to an expensive vet for the surgery, the claim amount would be a lot more.

Before we had to go through this, we always thought that surgeries were the costliest part of an illness. We did not really think about the frequent and oftentimes, big bills that a critical or chronic illness brings.

With that said, we could have maximised the clinical and surgical benefits if we played the game better, knowing what we know now. More on that later.

Post-claim loading

Our policy was due for renewal shortly after our first claim and we were unpleasantly surprised by a loading of 30% of our premium due to our claim. Our premium on renewal increased from S$500+ to close to S$800.

The loading imposed is probably subject to the type and severity of the illness. However, we feel that it was quite a big sum, especially when the only claim we made thus far was just S$630.

However, because Latte subsequently needed two more procedures under General Anaesthesia (we did not know this during renewal), it was ultimately a good decision to renew the insurance.

Final expenses

The policy covers final expenses for the middle- and highest-tier plans. S$250 is definitely insufficient by today's standards.

Home euthanasia and private cremation for a well-loved pet are common and cremation companies now offer various frills to give our pet a respectable send-off.

A simple private cremation costs around $300+ while home euthanasia costs anywhere between S$300 and S$600. We spent around S$800 in total for Latte's final expenses and claimed the full S$250 from Happy Tails.

The processing time for the final expenses claim was much quicker - it took the promised 10 working days.

Total claim

As Latte had 3 procedures under General Anaesthesia, we were able to receive a total claim amount of S$5,800, including final expenses. Our total bills were roughly S$11,000+.

Was it worth it?

I wouldn't be able to tell you whether buying insurance is going to be worth it. We do not know what the future brings. Some dogs would fortunately never need surgery. Some dogs may need very expensive surgeries while others may only incur out-patient bills throughout their lifetime. The type and size of costs vary widely depending on the condition.

In our situation, the total claim amount we got back is more than the total that we paid for yearly premiums. However, we could have put the premiums into investments instead and the returns could make part of the difference.

Here are some of the things to consider before signing up:

- Premium amount (would increase and loading may be imposed after a claim)

- Co-insurance rate

- Coverage limits

- Exclusions if your dog has a pre-existing condition

Insurance, at the end of the day, is a safety net. And if you have the financial means, pet insurance with its current limited coverage isn't as necessary.

If you are able to afford the yearly premiums and know that you usually don't have that much savings for sudden big bills, an insurance policy may come to your rescue, albeit slowly.

Maximise your Happy Tails policy

1. Check your policy renewal date: Is your policy renewing soon? If your pet needs to undergo an eligible procedure under General Anaesthesia and your vet advises that it is not time-critical, you might be better off waiting to do it after renewal to avoid being slapped with loading soon after.

2. Maximise claim under surgery-related bills: As claims for these bills have much higher limits, try to keep expensive procedures within those bills. Consult the vet and ask them to come up with a surgical plan. If your pet needs an ultrasound, scope, CT scan, or MRI that can be done before or during the day of surgery instead of after, choose that option.

3. 90 days post-surgery timeline: Your pet has S$300 of post-surgical benefits. You would likely use it all easily but take note of the time period.

4. Choice of vet: For serious conditions, you may be better off choosing a reputable, and naturally more expensive vet from the get-go than going for a more affordable but less qualified vet first. Vets with more expertise are able to provide a better surgical plan and incorporate all necessary diagnostics earlier on, which you might be able to claim more of.

Things we wish Happy Tails would improve on

Clinical coverage: In our opinion, pet insurance coverage in Singapore is far from adequate. You still need to worry about big bills, especially long-term ones, even when your pet is insured. Without a doubt, we need far better coverage for diagnostics (have you checked how much MRIs cost?!) and post-surgical bills.

Reduce processing time: Medical bills are the last thing we want to worry about when our pet is sick. With slow processing time, it means money wouldn't come in on time. With new medical bills being incurred and claims not coming in, financial stress builds up.

App/website experience: Currently, you can see your active Happy Tails policy and claim settlement letters when you log into the My Income website. However, that's all you can do - you cannot view or manage your pending Happy Tails claims.

I have no way to track the status except give Income a call. This adds to the uncertainty and unnecessary stress during a time when you should be focused on your pet.

It would also be good if we could submit claims on the website and get an immediate acknowledgement. Sending an email seems unreliable. There were times I did not get an auto-reply, leaving me feeling unsettled.

1 comment

Julie

Feeling the same – Pet insurance in Singapore is way inadequate. Long processing time and limited coverage with high policy premiums!

Feeling the same – Pet insurance in Singapore is way inadequate. Long processing time and limited coverage with high policy premiums!